Luxury goods are skyrocketing in price globally, this is why and where in the world to buy them.

Luxury shoppers have seen earlier this year that Louis Vuitton, Gucci, Hermes and Chanel have all raised their retail prices again – and it’s not only because of inflation.

Since the pandemic, the luxury business has become more complex and more popular than ever.

Since the re-opening of the world, health and hygiene habits have not been the only things to change. New consumer trends, behaviours and attitudes have emerged from the pandemic and seem to be here to stay.

With brands like Louis Vuitton, Dior, Versace and Chanel multiplying their prices for luxury goods, making that indulging purchase may need to happen sooner than you think before prices potentially go up once again.

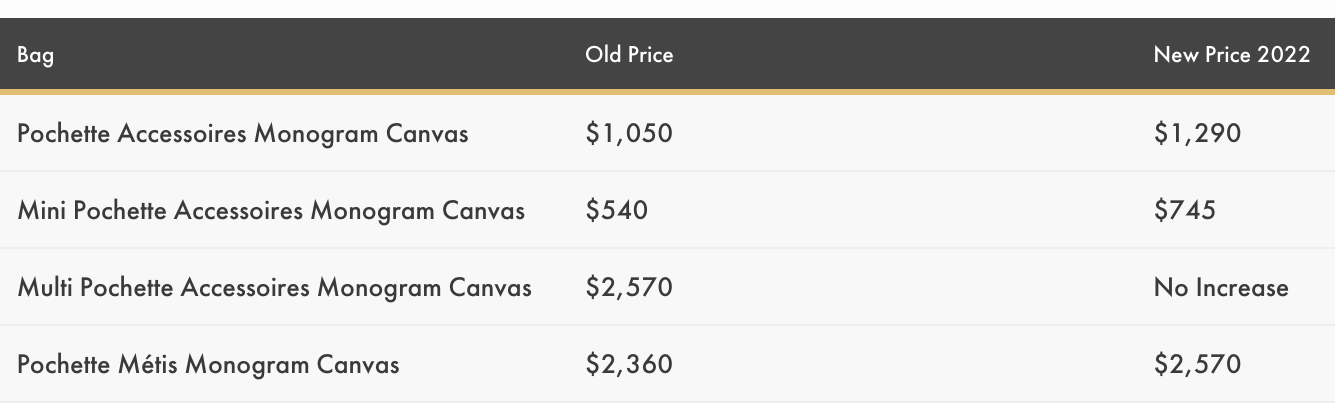

In 2021, Chanel increased its prices three times, and LV last increased prices from 9%-38% in February 2022.

Check out some of the price changes by LV here.

Why are luxury goods prices going up?

During the pandemic, the world of luxury shopping changed dramatically.

Motivations and opportunities to spend were challenged and limited – international travel was eliminated, social celebrations and dining out were banned and overall confidence in the economy declined.

Retail stores closed and opened and closed again abruptly, and fashion and marketing events either transitioned online or not at all. As a result, the costs of materials, resources and labour increased enormously.

Though the pandemic catapulted the prices of luxury goods, designer brands are “continuing to up their prices at a fast pace, even after the market rebounded,” says Forbes. Companies have quickly recovered from their losses as a result of the pandemic. This has been achieved by brands bumping up their prices in line with post-pandemic demands, especially in the United States, China and Korea.

However, another contribution to the hiked prices includes ‘scarcity’. To make products more desirable, companies make them less available. ‘Scarcity’ is what makes luxury goods of luxury status.

So how does ‘scarcity’ impact cost? The answer is simple – the rarer something is, the greater its value and desirability.

Who is leading the luxury market?

According to Luxury Daily, today’s luxury shoppers are aged 18-44. With the youth being more and

more interested in this sector, brands are urged to look into classic, staple designs that also emanate a sense of ‘cool’ and ‘uniqueness’.

Mega says that for the Millenial, simple luxuries attract them, but for Gen Z – nicknamed the ‘Tik Tok generation’ – “it’s all about taking styles from past generations and recreating them into larger than life pieces.” Essentially, they want to differentiate themselves from their peers and seek to make an identity statement.

“Luxury has a new meaning”, says Luxury Facts. No longer is it just health, wealth and prosperity. It has now transgressed to mean freedom, doing what you want to do, travelling, being with friends, being creative, out of the ordinary, being environmentally friendly, being socially conscious, being inclusive, being empathetic, and connecting with heritage and legacy, particularly for Gen-Zers.

Today’s luxury shopper demographic combined with the digital age means that shopping online and on social media giants like Facebook, Instagram and TikTok, is now more popular than ever. Hence, high-end brands have largely invested in online shopping affordances.

So, in short, the luxury sector and its future are informed by the new conscious shopper. Luxury companies will continue to benefit as long as they deliver.

Has this affected luxury brands? Will the rising prices decrease consumer demand?

Chanel bumped up their handbag and wallet prices in January – this was Chanel’s sixth price hike in about a year. For instance, Chanel raised the price of their Classic Medium Flap Bag from US$5200 in 2020 to US$8800 in 2022 – that’s a $3600 increase.

Other luxury labels like Hermes, Zegna, Prada, Rolex, Dior, Burberry, Tiffany and Co, and Moncler, as well as more casual brands, like Supreme, are also more expensive. However, High Snobiety reports that the escalating costs will not deter consumers from making more purchases, therefore, will not dent the fortunes of lavish designer brands.

CNA Luxury corroborates that “analysts are confident that revenues in 2022 will continue to surpass pre-pandemic levels.” For example, per Mashable SE Asia, Hermes generated US$2.7 million in sales on the first day of their new flagship boutique in Taikoo Hui Mall in Guangzhou, China. In addition, Chanel is so highly sought-out in Korea, that shoppers are limited to purchasing one bag per person.

Thus, it comes as no surprise that analysts will carry on predicting the ballooning of luxury goods’ prices. Citi’s Chauvet says that with material and labour costs soaring, prices will ultimately continue to escalate. Some brands are “even talking about double-digit price increases, Moncler in particular,” states Chauvet. Inevitably, these increases will advantageously deliver double-digit revenue for the luxury industry.

While the past few years have seen consumers leaning more towards ‘experiences’, over products, the pandemic has inverted this trend. Shoppers are preferring timeless, iconic and expensive goods, or even better, ‘experience-based goods’ – these include luxury cars, yachts, NFTs, art, travel and more.

In fact, 30-40% of luxury sales, including fashion items, were generated by shoppers in transit and abroad, making them an experience-based good. It’s more than safe to say that the luxury sector has not run its course.

Where can I buy ‘cheaper’ luxury goods?

Europe – the largest ‘in-season’ outlet

As international travel returns, luxury buyers have been incentivised to shop depending on location. This is because different places afford different prices for expensive goods. Forbes suggests that Southeast Asian countries – namely Japan for brands like LV and Gucci – house some of the highest-priced European luxury items in contrast to those in Europe and the US.

Since the pandemic and Brexit, the UK has lost high-end tourists to Europe as a consequence of the lack of tax-free shopping. The UK is the only European nation not to offer a tax rebate to tourists from outside the EU.

Therefore, wealthier shoppers, particularly those from China and Japan, are flying to European destinations like France, Italy and Spain in search of broader selections and lower prices. According to Bloomberg, 69% of travellers to the UK said they flew to the UK for the purpose of cheaper deals on luxury goods. Bloomberg further states that “spending by US visitors to the EU has climbed to 91% of pre-pandemic levels, while only reaching 49% in the UK.”

To summarise, if you’re looking for more luxury bang for your buck, head to destinations like Paris and Milan. These locations sell luxury European goods for cheaper because import tax, duty tax and transportation costs are not included.

Secondhand markets

Having previously been disregarded, secondhand markets continued to boom over the past few years.

Since COVID, the culture of fashion has become ‘uber-casual’, and during lockdown, people cleaned out their closets more often than usual out of necessity for income or even just out of pure boredom.

Because the interest in reselling old possessions has grown, more people are going on resale websites to sell. If a product is on The RealReal, it’s cool.

Brands have been more inclined to embrace circular business models and serve the niche and modern consumer preference of buying pre-loved, luxuriant goods. Online services like Vestiare Collective, The RealReal, Poshmark and ThredUp offer authentification services and encourage their users to consign their items in exchange for store credit.

In February 2021, Alexander McQueen partnered with Vestiare Collective to launch a buy-back program called ‘Brand Approved’, allowing consumers to turn in their pre-worn McQueen pieces in exchange for store credit.

Brands like Rachel Comey, Marques’ Almeida, Gucci and Oscar de la Renta – just to name a few – have also welcomed resale sites. It’s very likely that more brands will adopt this strategy too.